Business Background and Challenges

In recent years, the anti-fraud transaction system based on artificial intelligence has gradually realized the implementation practice in many bank scenarios and has become a key link in the intelligent transformation of banks. Compared to the traditional anti-fraud trading system based on expert rules, machine learning algorithm can more widely capture the data characteristics of different dimensions, deeply capturing the potential laws of data, and achieve a higher call rate.

The original anti-fraud transaction system of a bank customer is built based on expert rules. Facing the growing and changing business, it is increasingly unable to meet the development needs in response time and call rate. Therefore, the bank expects to build a new anti-fraud transaction system based on artificial intelligence system. However, there are many engineering challenges when artificial intelligence technology is applied to the online system of anti-fraud transactions in banks.

- Firstly, the bank requires millisecond response time to online business, which has high requirements for system latency and throughput performance.

- Secondly, the business requires the consistency of offline and online feature extraction to avoid issues such as data crossing and inconsistency, so it needs expensive online and offline consistency verification cost.

- Finally, due to the various needs of banking business, the cost of developing and deploying new feature scripts and models is high.

Solution

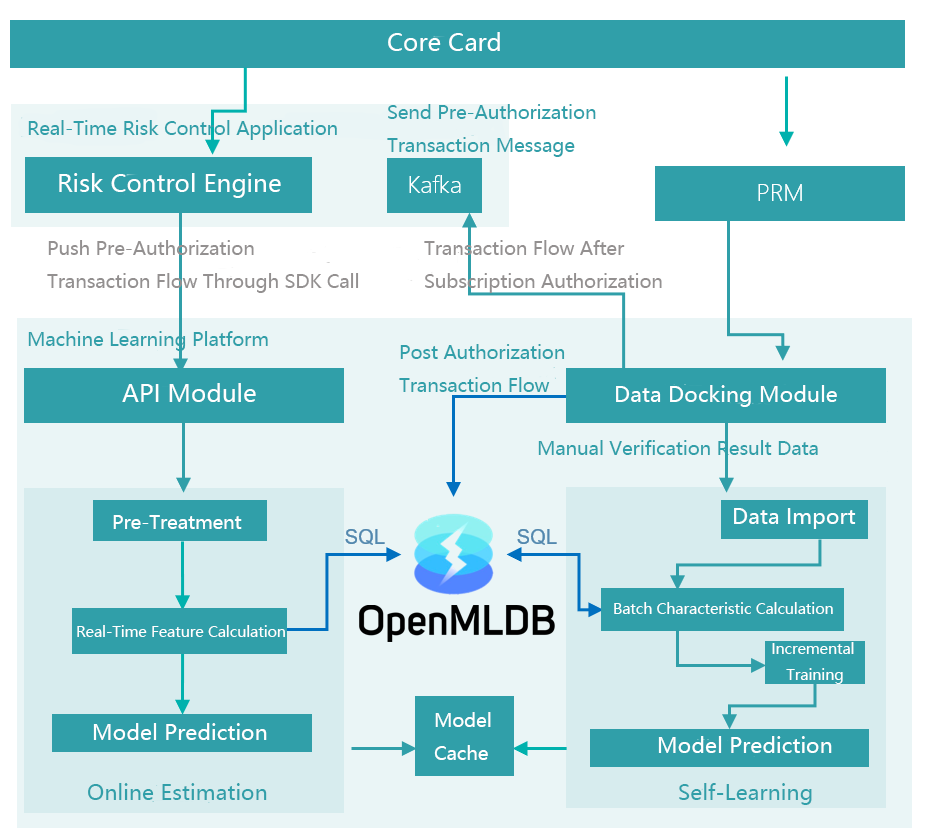

The bank customer finally selected and built an AI-powered anti-fraud system based on OpenMLDB that is used as the feature extraction and management platform. The following figure shows the design of the system. OpenMLDB plays a key role of feature engineering in the whole system and provides a full stack of FeatureOps solutions. Through the development of SQL based feature extraction script, OpenMLDB runs through the whole machine learning closed loop of off-line development, on-line serving, and self-learning of business system, driving the effective and efficient operation of the whole anti-fraud system.

The anti-fraud system based on OpenMLDB can well overcome the engineering challenges related to the feature engineering for AI systems. At the performance level, based on the efficient in-memory index of OpenMLDB, the whole system meets the system latency requirement of 20 milliseconds. For online and offline consistency, because OpenMLDB is used for feature extraction for both offline development and online serving based on the same SQL scripts and unified execution engine, its online and offline consistency is naturally guaranteed, and no additional online and offline consistency verification cost is required. Moreover, through the SQL-centric experience, it greatly reduces the cost of development, management and deployment, and enables the ability of rapid business expansion.

Business Value

The anti-fraud system based on OpenMLDB has brought significant business value to the bank's customers:

- Significant increase in the call rate: The bank's customers upgraded the original anti-fraud system based on expert rules to a machine learning based solution, thus greatly improved the call rate of anti-fraud transactions. OpenMLDB provides a closed-loop feature engineering platform for this AI-powered anti-fraud system.

- Significant improvement of latency: With the significant growth of business volume, the customer's original system based on expert rules does not have good scalability, and the response time is at the level of 100 milliseconds, which cannot meet the rapidly growing business. After using OpenMLDB, based on its low latency and high throughput, the response time is shortened to about 20 milliseconds to meet the needs of rapid business development and expansion.

- Enabling rapid business expansion and online capability: OpenMLDB supports the use of SQL to develop feature calculation scripts, naturally ensures the consistency between online and offline, and supports rapid deployment to online. Based on the above characteristics, the banking business can be expanded rapidly, and the development and online cycle and cost of new models can be greatly reduced.